Our Blogs

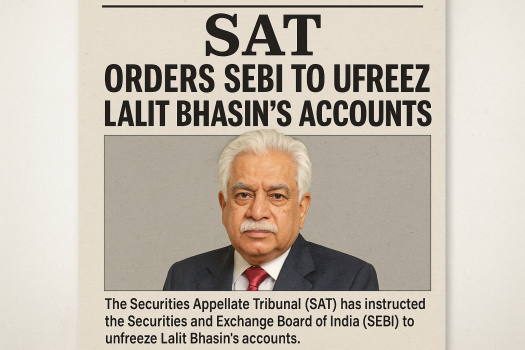

SAT Orders SEBI to Unfreeze Lalit Bhasin’s Accounts

SAT Directs SEBI to Unlock Lalit Bhasin’s Accounts The Securities Appellate Tribunal (SAT) recently addressed the case involving Lalit Bhasin, w

Read More →

Sanjiv Bhasin Challenges SEBI’s Front-Running Order at SAT

Sanjiv Bhasin Appeals SEBI Order at SAT in Front-Running Case Sanjiv Bhasin, former director of IIFL Securities and a well-known stock market commenta

Read More →Categories

Popular Posts

GST to Change the Face of Warehousing

GST to Change the Face of Warehousing

Cases when ITC is not available under GST

Cases when ITC is not available under GST

GSTR 9C – Part II

GSTR 9C – Part II

GST Audit/Reconciliation and Certification (Form GSTR-9C)

GST Audit/Reconciliation and Certification (Form GSTR-9C)

Taxation: History of Goods and Service Tax for India

Taxation: History of Goods and Service Tax for India

GSTR 9C – Part III

GSTR 9C – Part III

How your small pie of Tax builds the entire nation.

How your small pie of Tax builds the entire nation.

Aten Papers & Foam IPO Day 1: Check subscription status and other details

Aten Papers & Foam IPO Day 1: Check subscription status and other details

Taxation of Indian Bank Account Income for NRIs: Key Rules and Guidelines

Taxation of Indian Bank Account Income for NRIs: Key Rules and Guidelines

Foreign Investors Return to Indian Markets After RBI’s Surprise Rate Cut in June 2025

Foreign Investors Return to Indian Markets After RBI’s Surprise Rate Cut in June 2025