Our Blogs

Mutual Funds Push Back on SEBI’s New Scheme Rules

The Securities and Exchange Board of India (SEBI) has proposed significant changes to mutual fund (MF) scheme categorization and management that have

Read More →

Vikran Engineering IPO: Price Band, Dates, Key Details 2025

Vikran Engineering IPO Launch Details Vikran Engineering, a notable player in the Engineering, Procurement, and Construction (EPC) sector, is all set

Read More →

Star Imaging and Path Lab IPO: Strong Subscription, Muted Listing

Star Imaging and Path Lab shares made a flat debut on the BSE SME platform on August 18, 2025, listing at ₹142 per share, which is exactly the same

Read More →

U.S. IPO Boom in 2025: Big Rush Before the Window Closes

The U.S. IPO market in 2025 is experiencing a significant resurgence, with 214 IPOs as of August 14, almost doubling the 114 IPOs recorded by the same

Read More →

Regaal Resources IPO Day 2: 9.07x Strong Fundamentals

On Day 2 of the Regaal Resources IPO (August 13, 2025), the issue has been subscribed approximately 9.07 times so far. This shows a significant jump f

Read More →

Regaal Resources IPO Day 1: Key Updates & Should You Apply?

IPO Live Subscription & Key Dates Grey Market Premium (GMP) & Expected Listing Gains Financial Highlights Expert & Brokerage Views Should

Read More →

SEBI Investigates Embassy REIT and WeWork India Following S&W Complaint

Sterling & Wilson Renewable Energy Ltd (S&W) has filed formal complaints with SEBI against both Embassy Office Parks REIT and IPO-bound WeWork

Read More →

JSW Cement IPO Day 1 Review: Low Subscription, Weak Grey Market Sentiment

JSW Cement IPO Day 1 Highlights (August 7, 2025) Subscription Status: Grey Market Premium (GMP): Issue Structure & Listing Timeline: Key Analyst T

Read More →

Elevation Capital Prepares 9 Portfolio Companies for IPOs in 2025–2027

Elevation Capital is preparing for a significant wave of public listings, lining up nine of its portfolio companies to go public over the next 12–24

Read More →

Highway Infra IPO Day 1: 3.45x Subscribed, GMP Hints 57% Jump

Subscription Status (Day 1, 10 AM): Grey Market Premium (GMP) & Listing Pop: IPO Details: Financial Highlights: Key Business Segments: Investor Ta

Read More →

Aditya Infotech IPO: Strong GMP and Listing Preview

The Aditya Infotech IPO is set to be listed on both the BSE and NSE on August 5, 2025. The public issue received an overwhelming response, being subsc

Read More →

Brookfield-Backed CleanMax Set for ₹4,000–5,000 Crore Confidential IPO

Brookfield-backed CleanMax Enviro Energy Solutions, a leading renewable energy firm based in Mumbai, is set to file for an initial public offering (IP

Read More →

Brigade Hotel Ventures Disappoints with Weak Stock Market Debut

Brigade Hotel Ventures had a disappointing stock market debut on July 31, 2025, with shares opening at a discount of nearly 10% compared to their IPO

Read More →

Jane Street Seeks Extension as SEBI Probes Trading Allegations

Jane Street Group, a major U.S. trading firm, is seeking an extension from the Securities and Exchange Board of India (SEBI) to respond to allegations

Read More →Jane Street vs SEBI: Battle Over Market Manipulation Allegations

Jane Street’s Defense Against SEBI’s Stock Market Manipulation Allegations Background of SEBI’s Allegations In early July 2025, the

Read More →

TSC India IPO Allotment Today: Latest Updates and GMP

TSC India IPO Allotment: Key Updates (as of July 28, 2025) Latest GMP (Grey Market Premium) How to Check TSC India IPO Allotment Status You can check

Read More →

Indiqube Spaces IPO: Track Allotment Status, GMP Trends & Key Dates – All in One Place!

Indiqube Spaces IPO Allotment Date Grey Market Premium (GMP) Update Steps to Check Indiqube Spaces IPO Allotment Status Online You can check your IPO

Read More →

Patel Chem IPO Day 1: 42% GMP Listing Pop!

OverviewPatel Chem Specialities IPO opened for subscription on July 25, 2025, and will close on July 29, 2025, with a price band of ₹82-84 per share

Read More →

NSDL IPO: Dates, Share Sale Structure, Major Shareholders & Listing Info

NSDL IPO: RHP Filing, Key Dates, Issue Size, and Details Overview National Securities Depository Limited (NSDL), India’s pioneering and largest depo

Read More →

Why Global Regulators Are Investigating Jane Street’s Trades in Indian Markets

Jane Street Under Global Regulatory Scrutiny Overview US-based trading giant Jane Street is facing a global regulatory spotlight following allegations

Read More →

Shanti Gold International IPO Opens Soon: Price Band Set at ₹189-199 Per Share-Key Details Inside

Shanti Gold International IPO: Key Details The Shanti Gold International IPO will open for bidding on July 25 and close on July 29. Shanti Gold Intern

Read More →

Strong IPO Listing: Anthem Biosciences Shares Gain 27% on NSE Debut

Anthem Biosciences Shares: Strong Market Debut Key Listing Details IPO Subscription and Price Band Company Overview Financial and Market Snapshot Deta

Read More →

IndiQube Spaces to Launch ₹700 Crore IPO on July 23; Check Price Band, Important Dates, and Issue Details

IndiQube Spaces IPO: Key Details IPO Schedule & Dates Event Date Anchor Book Opens July 22, 2025 IPO Opens for Subscription July 23, 2025 IPO Clos

Read More →

Smartworks Coworking Spaces Lists at ₹435, Marks Promising Start Post-IPO

Smartworks Coworking Spaces: IPO Listing Highlights Debut Performance IPO Details Use of Proceeds Investor Takeaways Summary Table IPO Metrics Value L

Read More →

Fraud in the Shadows: Why Only Short-Sellers Speak Up

No one “blows the whistle” until a short-seller appears because of a mix of incentives, access to information, risks, and instit

Read More →

SEBI vs Jane Street: ₹4,843 Cr Escrow Marks Start of Legal Battle

Jane Street’s ₹4,843.6 Crore Escrow Deposit: Context and Latest Developments Background Key Actions Taken Current Status Key Details Table Event D

Read More →

SAT Orders SEBI to Unfreeze Lalit Bhasin’s Accounts

SAT Directs SEBI to Unlock Lalit Bhasin’s Accounts The Securities Appellate Tribunal (SAT) recently addressed the case involving Lalit Bhasin, w

Read More →

Sanjiv Bhasin Challenges SEBI’s Front-Running Order at SAT

Sanjiv Bhasin Appeals SEBI Order at SAT in Front-Running Case Sanjiv Bhasin, former director of IIFL Securities and a well-known stock market commenta

Read More →

SEBI Proposes Expansion of Credit Rating Agencies’ Mandate

SEBI Proposal: Allowing Rating Agencies to Rate Assets Outside Its Ambit Overview The Securities and Exchange Board of India (SEBI) has proposed a sig

Read More →

SEBI Weighs Shift to Fortnightly Expiry in Index Options Market

SEBI’s Consideration of Fortnightly Expiry for Index Options The Securities and Exchange Board of India (SEBI) has been actively reforming the d

Read More →

SEBI Targets Jane Street Over Gains in Turbulent India-Pakistan Markets

Jane Street’s Bullish Bets Amid India-Pakistan Tensions Jane Street, a major global quantitative trading firm, has recently come under scrutiny

Read More →

India Inc Hits Pause: The Story Behind the ₹5 Trillion Cash Reserve

India Inc is currently holding approximately ₹5 trillion in cash and cash equivalents, which represents nearly 12% of their total assets.&

Read More →

SEBI’s New Related-Party Disclosure Rules: What You Need to Know

The Securities and Exchange Board of India (SEBI) has introduced revised disclosure rules for related-party transactions (RPTs) that have sp

Read More →

How Groww’s Demat Transition Affects Your Mutual Fund Holdings

Groww’s recent demat switch for mutual funds means that, by default, new mutual fund purchases on Groww are now held in your demat ac

Read More →

IPO Revival: $2.4 Billion Expected in July as Indian Markets Rally

India’s IPO market is experiencing a significant revival, with companies expected to raise an estimated $2.4 billion through initial public offeri

Read More →

SEBI Proposes Stronger Governance Framework for Market Institutions

SEBI Seeks Better Governance at Market Institutions: Key Proposals and Rationale The Securities and Exchange Board of India (SEBI) has proposed a sign

Read More →

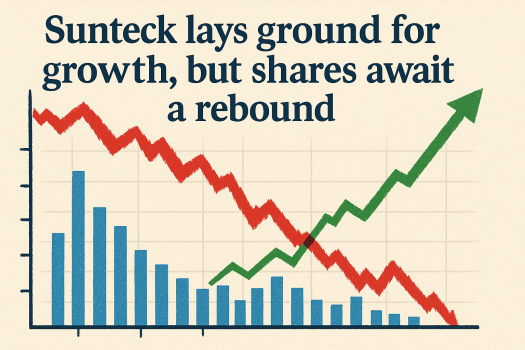

Sunteck Realty’s Growth Outlook and Market Impact

Sunteck Realty: Growth Prospects and Share Performance Growth Foundation Sunteck Realty is positioning itself for robust growth in FY26, with analysts

Read More →

Aditya Birla Lifestyle Brands Growth Strategy: Investing ₹300 Crore Every Year

Aditya Birla Lifestyle Brands: Annual Investment and Growth Plans Aditya Birla Lifestyle Brands Limited (ABLBL), recently demerged from Aditya Birla F

Read More →

Sensex Plunges 900 Points: Impact of US Attack on Iran and Rising Oil Prices on Indian Markets

Why Did the Sensex Crash 900 Points After the US Attack on Iran? The sharp fall in the Indian stock market, with the Sensex crashing over 900 points,

Read More →

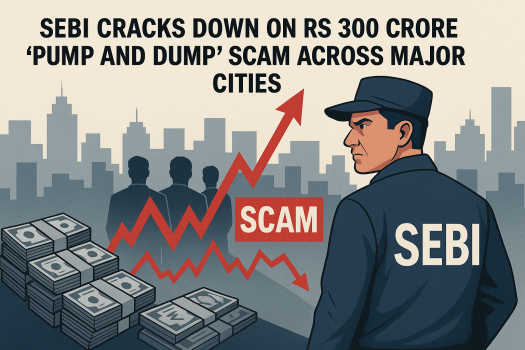

SEBI Cracks Down on Rs 300 Crore ‘Pump and Dump’ Scam Across Major Cities

SEBI Raids on Shell Companies in Rs 300 Crore ‘Pump and Dump’ Scheme Overview The Securities and Exchange Board of India (SEBI) conducted large-sc

Read More →

How Global Conflicts Are Shaping FPI Sentiment on Indian Market

How Global Conflicts Are Tempering FPI Optimism on India Foreign Portfolio Investors (FPIs) have become increasingly cautious about India’s outlook

Read More →

Easier ESOPs for Startups and Faster PSU Delisting Under New SEBI Rules

Easier Startup ESOPs Recent SEBI Reforms:SEBI has introduced significant reforms to ease the use of Employee Stock Option Plans (ESOPs) for startup fo

Read More →

SEBI Impounds ₹11.37 Crore, Bars Sanjiv Bhasin in Market Manipulation Case

SEBI Bars Sanjiv Bhasin for Stock Manipulation Summary of Action The Securities and Exchange Board of India (SEBI) has barred Sanjiv Bhasin, former di

Read More →

Local Office Demand: How Indian Firms Are Shaping the Market

Local Firms Drive Office Demand in India Surge in Domestic Office Leasing Local, or domestic, firms have emerged as a major force in driving office sp

Read More →

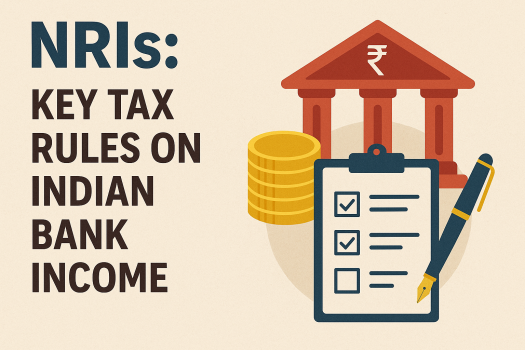

Taxation of Indian Bank Account Income for NRIs: Key Rules and Guidelines

Key Tax Rules for NRIs on Indian Bank Income Non-Resident Indians (NRIs) are subject to specific tax rules in India regarding income earned from India

Read More →

Impact of SEBI ESG rules on mid-sized firms

SEBI’s New ESG Debt Framework: Impact on Mid-Sized Firms The Securities and Exchange Board of India (SEBI) has introduced a comprehensive and string

Read More →

Foreign Investors Return to Indian Markets After RBI’s Surprise Rate Cut in June 2025

Foreign Investors Infuse ₹3,346.94 Crore in Indian Markets This Week Foreign investors injected ₹3,346.94 crore into Indian equities this week, ma

Read More →

Aten Papers & Foam IPO Day 1: Check subscription status and other details

Aten Papers & Foam IPO Day 1: Key Details Subscription Status (Day 1, as of 12:10 PM) Grey Market Premium (GMP) IPO Details Important Dates Compan

Read More →

Jainik Power & Cables IPO Allotment Today: Check Status, GMP, and Listing Date Details

Jainik Power & Cables IPO Allotment, GMP, and Listing Date – Key Details Allotment Status (June 13, 2025):The basis of allotment for the Jainik

Read More →Categories

Popular Posts

GST to Change the Face of Warehousing

GST to Change the Face of Warehousing

Cases when ITC is not available under GST

Cases when ITC is not available under GST

GSTR 9C – Part II

GSTR 9C – Part II

GST Audit/Reconciliation and Certification (Form GSTR-9C)

GST Audit/Reconciliation and Certification (Form GSTR-9C)

Taxation of Indian Bank Account Income for NRIs: Key Rules and Guidelines

Taxation of Indian Bank Account Income for NRIs: Key Rules and Guidelines

Taxation: History of Goods and Service Tax for India

Taxation: History of Goods and Service Tax for India

GSTR 9C – Part III

GSTR 9C – Part III

Aten Papers & Foam IPO Day 1: Check subscription status and other details

Aten Papers & Foam IPO Day 1: Check subscription status and other details

Brookfield-Backed CleanMax Set for ₹4,000–5,000 Crore Confidential IPO

Brookfield-Backed CleanMax Set for ₹4,000–5,000 Crore Confidential IPO

How your small pie of Tax builds the entire nation.

How your small pie of Tax builds the entire nation.