Blog Post

Posted on June 24, 2025

Growth Foundation

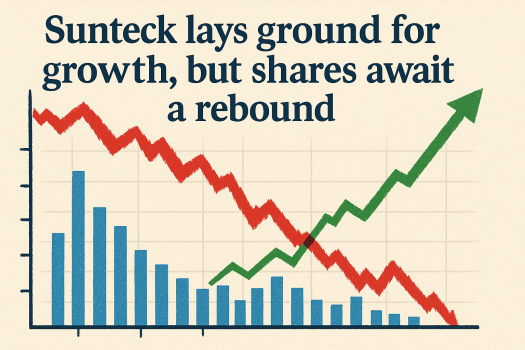

Sunteck Realty is positioning itself for robust growth in FY26, with analysts forecasting a significant 56% increase in revenue and an 86% jump in per-share earnings by 2026 compared to the last 12 months. This anticipated acceleration in growth is notably higher than the historical average (8.1% CAGR over the past five years) and outpaces the broader real estate industry, which is expected to grow at 22% annually. Despite recent analyst downgrades to revenue and EPS estimates, the company’s long-term growth outlook remains positive, driven by a strong project pipeline and strategic initiatives.

Current Share Performance

Market Sentiment and Analyst View

| Aspect | Details |

|---|---|

| Revenue Growth (2026) | Forecast +56% YoY (vs. 8.1% CAGR past 5 years; industry avg. 22%) 4 |

| EPS Growth (2026) | Forecast +86% YoY to ₹19.04 |

| Share Price (1 year) | -27% (vs. Sensex and sector gains) |

| YTD Performance | -24.18% (Sensex: -3.90%) |

| Analyst Sentiment | Bearish near-term; long-term price target unchanged |

| Promoter Action | Increased stake to 63.25% |

Sunteck Realty is laying a solid foundation for accelerated growth, but its shares remain under pressure due to recent earnings downgrades and broader market caution. While the fundamentals suggest a potential for strong recovery, a sustained rebound in the stock price is likely contingent on visible execution of growth plans and improved investor sentiment.

Ref: Sunteck Realty readies recipe for a strong FY26 even as shares await a rebound

328 Views 0 comments

GST to Change the Face of Warehousing

Cases when ITC is not available under GST

GSTR 9C – Part II

GST Audit/Reconciliation and Certification (Form GSTR-9C)

Taxation of Indian Bank Account Income for NRIs: Key Rules and Guidelines

Taxation: History of Goods and Service Tax for India

GSTR 9C – Part III

Aten Papers & Foam IPO Day 1: Check subscription status and other details

Brookfield-Backed CleanMax Set for ₹4,000–5,000 Crore Confidential IPO

How your small pie of Tax builds the entire nation.

Comments