Blog Post

Posted on July 25, 2025

Overview

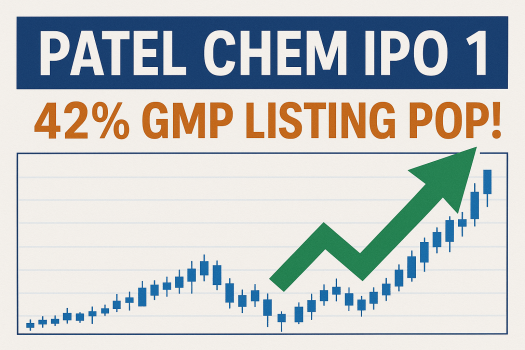

Patel Chem Specialities IPO opened for subscription on July 25, 2025, and will close on July 29, 2025, with a price band of ₹82-84 per share and an issue size of ₹58.80 crore, consisting entirely of a fresh issue of 70 lakh shares. Grey Market Premium (GMP) signals an expected 42% listing gain, with the latest GMP at ₹35 per share, as of July 25, 2025, indicating strong investor interest and an anticipated listing price of around ₹119 per share for investors allotted at the upper price band.

At the prevailing GMP and issue price of ₹84, Patel Chem Specialities shares could list at ₹119, a premium of 41.67%. However, investors must know that GMP is subject to swift change.

Key Dates and Details:

Subscription Status: As of the opening day, live subscription figures are yet to be finalized and reported, as the IPO window has just opened. Investors can monitor the ongoing subscription status on BSE SME and registrar sources through the offering period.

GMP & Listing Pop: The quoted GMP of ₹35 corresponds to an estimated listing gain of around 42% over the upper price band, with the “subject to sauda” (a premium for IPO application in the grey market) at ₹42,600. These levels suggest robust demand, but it is important to note that grey market activity is unofficial, and listing gains are never guaranteed.

For prospective investors, this IPO has garnered positive buzz in the market, but participation should consider company fundamentals and valuation rather than just GMP trends. Check allocation status post-closing on the registrar’s portal and refer to official subscription data once released.

Ref: Ashish Kacholia invested in this SME IPO that has 42% GMP. Check all details

308 Views 0 comments

GST to Change the Face of Warehousing

Cases when ITC is not available under GST

GSTR 9C – Part II

GST Audit/Reconciliation and Certification (Form GSTR-9C)

Taxation of Indian Bank Account Income for NRIs: Key Rules and Guidelines

Taxation: History of Goods and Service Tax for India

GSTR 9C – Part III

Aten Papers & Foam IPO Day 1: Check subscription status and other details

Brookfield-Backed CleanMax Set for ₹4,000–5,000 Crore Confidential IPO

How your small pie of Tax builds the entire nation.

Comments